Finding Your Dream Loan

Let us help you find the right loan program for your dream home.

Our Comprehensive Home Loan Solutions

Buying your first home can be confusing, but we make the process simple. From assessing your borrowing power to securing pre-approval and accessing government incentives, we guide you through every step with clear advice and support.

Refinancing may help you lower your repayments, access equity, or secure a better loan. We compare lenders, review your current loan, and manage the refinance process from start to finish to ensure it’s the right move for you.

We help property investors structure loans that support long-term growth and cash flow. Whether you’re purchasing your first investment or expanding a portfolio, we’ll find finance solutions that align with your strategy.

KBA Home Loans has a simple online process for loan applications

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home.

Apply NowInitial Consultation

We start with a free, no-obligation consultation to understand your goals, income, expenses, and borrowing capacity. We’ll explain your options clearly and answer any questions before you commit to anything.

Provide Your Details

You’ll provide key documents such as payslips, tax returns, bank statements, and ID. This allows us to accurately assess your financial position and prepare your application correctly from the start.

Conditional Approval

We submit your application to a suitable lender to obtain conditional approval. This gives you confidence to start property hunting, knowing how much you can borrow and under what conditions.

Find Your Dream House

With pre-approval in place, you can confidently make offers or bid at auction. We review contracts, liaise with your conveyancer or solicitor, and ensure the property meets lender requirements.

Unconditional Approval

Once a property is secured, we finalise valuations and submit remaining documents to obtain unconditional approval. This confirms your loan is fully approved and ready to proceed to settlement.

Settle Your Loan

Coordinating with the lender, conveyancer, and agent will ensure a smooth settlement. Once complete, your loan funds are released and you receive the keys to your new home.

Calculate your Mortgage

We help All people to fund their next house purhcase

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage financing process with per sonalized loan options that save you time and money.

90%

Business from Referrals

45+

Minute Verbal Commitment

We help people to fund their dream house

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage.

""

Read the latest news on Lending from KBA Home Loans

How a Mortgage Broker Works And Why It Can Save You Time and Money

Choosing a home loan is one of the biggest financial decisions most people will ever make. With hundreds of loan

- KBA Home Loans

- No Comments

- December 26, 2025

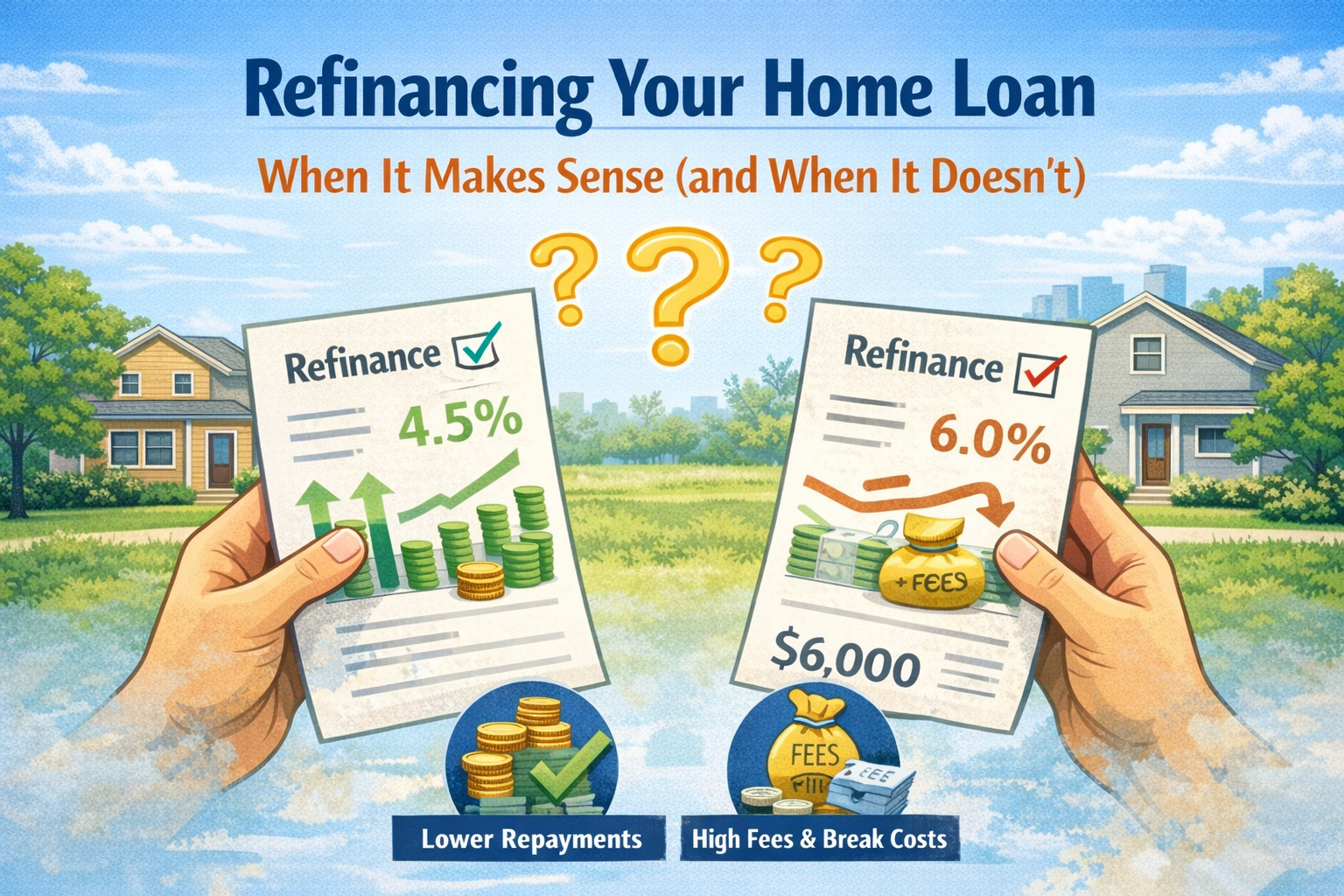

Refinancing Your Home Loan: When It Makes Sense (and When It Doesn’t)

Refinancing your home loan can be a powerful financial move—but it isn’t always the right one. While refinancing can help

- KBA Home Loans

- No Comments

- December 19, 2025

First Home Buyer Guide: From Pre-Approval to Settlement

Understanding the First Home Buying Process in Australia Buying your first home is an exciting milestone, but it can also

- KBA Home Loans

- No Comments

- December 17, 2025

Have you any questions about our mortgage company or buy your home?

No, you don’t pay anything to use KBA Home Loans. Our service is typically paid for by the lender once your loan settles. If there are ever any costs involved due to complex scenarios, we’ll always disclose this upfront so there are no surprises.

Yes, you can refinance your mortgage at almost any time. It can be a good idea if interest rates have dropped, your fixed rate is ending, your financial situation has improved, you want lower repayments, better loan features, or to access equity. Before refinancing, it’s important to consider any exit or break costs and ensure the long-term savings outweigh the fees. KBA Home Loans can help compare options and confirm whether refinancing will genuinely benefit you.

You may be eligible for the First Home Owner Grant (FHOG) if you’re buying or building your first home and meet your state or territory’s criteria, such as property price limits, residency requirements, and living in the home as your principal place of residence. Eligibility rules vary across Australia, so KBA Home Loans can assess your situation and confirm whether you qualify and how the grant can be used toward your purchase.

Yes, you can absolutely pay off your mortgage early with extra repayments without any penalties.

LMI is typically required when the down payment is less than 20% of the home's purchase price. It protects the lender in case the borrower defaults on the loan.

Helping you navigate your home loan with confidence

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage financing process with personalized loan options that save you time and money.